RoDTEP Scheme (Remission of Duties or Taxes on Export Products)

Overview

The RoDTEP Scheme came into existence because the USA filed a complaint against India at the World Trade Organization (WTO). USA argued that export subsidies like the MEIS scheme given by GOI give undue benefits to Indian exporters and it is against the WTO rules. Consequently, India lost the case at WTO, and the ruling was in favor of the USA. It meant that now India had to stop the MEIS scheme and come up with a new WTO-compliant scheme to help Indian exporters. Hence, the Finance Minister in her Budget Speech on 1st February 2020 announced that the Scheme for Remission of duties and taxes on export products would be launched. Consequently, the RoDTEP Scheme was approved by the Union Cabinet on 13th March 2020 and it came into effect on 1st January 2021 and will be until 2025.

What is the RoDTEP Scheme?

Under the RoDTEP Scheme, the exporters can get the refund of embedded central, state, and local duties or taxes that were not getting refunded under any of the existing schemes earlier. It is expected that the scheme will significantly impact India's competitiveness in the international market in the next 5 to 10 years and would work on the principle that taxes/duties should not be exported, It should either be exempted or remitted to exporters. Implementation of the RoDTEP Scheme is done by the schemes earlier. It is expected that the scheme will significantly impact India's Customs, Icegate Portal. On 17th August 2021, Government released the guidelines and benefit rates under RoDTEP Scheme for 8555 tariff lines. The rebate rate varies from 0.5% to 4% of FOB value with a cap on value per unit on products where it is required. Below is a diagram showing the history of export promotion schemes, for a better understanding of their evolution

Features of RoDTEP Scheme

Currently, only the GST and the import customs duties levied on inputs required for the manufacturing of export products are either exempted or refunded in some or another way. Input tax credit (ITC) of GST paid is available, and also if exported on payment of duty then IGST refund can be claimed. Import Custom duties on raw materials are exempted through the Advance Authorization scheme or refunded through the Duty Drawback scheme. However, still, there are many duties and taxes levied by the Central and State government which are not refunded. It adds up to the final cost of resultant products and makes Indian products uncompetitive in the global market.

The following features of the RoDTEP Scheme has been given below. (Refer to the image)

Refund of Embedded Duties and Taxes

The RoDTEP Scheme aims to refund all those hidden taxes and levies, For example:

- Central & state taxes on the fuel (Petrol, Diesel, CNG, PNG, and coal cess, etc.) used for

transportation of export products. - The duty levied by the state on electricity used for manufacturing.

- Mandi tax levied by APMCs.

- Toll tax & stamp duty on the import-export documentation. Etc.

WTO Compliant Scheme

The RoDTEP Scheme is WTO compliant since it is not an additional Incentive, it is just the refund of hidden taxes. The RoDTEP Scheme will help the exporters to meet international standards and make their goods cost-competitive in the international market by assured duty benefits.

Ineligible Supplies / Items / Categories under the RoDTEP scheme

The RoDTEP Scheme would operate in a budgetary framework for each financial year and a 12,400 Cr outlay has been announced for the FY 2021-22.

Find the list of ineligible goods under the RoDTEP Scheme.

- Export of imported goods is given under paragraph 2.46 of FTP.

- The goods which are restricted for export beneath “Schedule-2 of Export Policy in ITC (HS).

- Goods which are banned for export beneath “Schedule-2 of Export Policy in ITC (HS).

- Supplies of products manufactured through DTA units to SEZ/FTWZ units.

- Export of goods taken into use after manufacturing.

- The Exports for which the electronic documentation in ICEGATE EDI has not been made.

- The exported goods claiming the benefits of notification No. 32/1997- Customs dated 1st April 1997.

- The goods are exported from Free Trade Zones (FTZ) Export Processing Zones(EPZ) or Special Economic Zones(SEZ).

- The goods obtained or exported through EOU & produced in EHTP and BTP.

- Deemed Exports.

- The Export good is subjected to a minimum export price or export tax.

- Products manufactured partly or wholly in a warehouse beneath section 65 of the Customs Act, 1962 (52 of 1962).

- Goods exported under Advance License/Special advance license or tax-free import authorization.

Introduction of RoDTEP Scheme to Chemicals, Pharmaceuticals, Iron & Steel Exporters

The government has extended the RoDTEP scheme to Chemical, Pharma & Iron & steel Exporters covering chapters 28,29,30 & 73 of ITC HS code.

The Rate of Incentive is in the range of 0.5% to 2%, which varies as per the ITC HS Code.

The majority of the Items are given 0.8% Incentive.

As per the current notification, this scheme will only be applicable for all Exports made after 15.12.2022 till 30.09.2023

We request all our Clients, Kindly Please make all the necessary declarations at the time of Filing Shipping Bills & Do not forget to tick YES for RoDTEP.

To claim RoDTEP Incentives, Exporters need to get a Class - 3 Digital Signature along with mandatory Registration on the Icegate Website.

Procedure to avail the benefits under RoDTEP Scheme

There are the four mandatory steps to avail the benefits under RoDTEP Scheme as follows -

Declaration in the Shipping Bills -

It is mandatory for the exporters to indicate in their Shipping Bill whether or not they intend to claim RoDTEP on the export items from 01/01/2021. Unlike Drawback, there will be no need to declare any separate code or schedule serial number for RoDTEP.

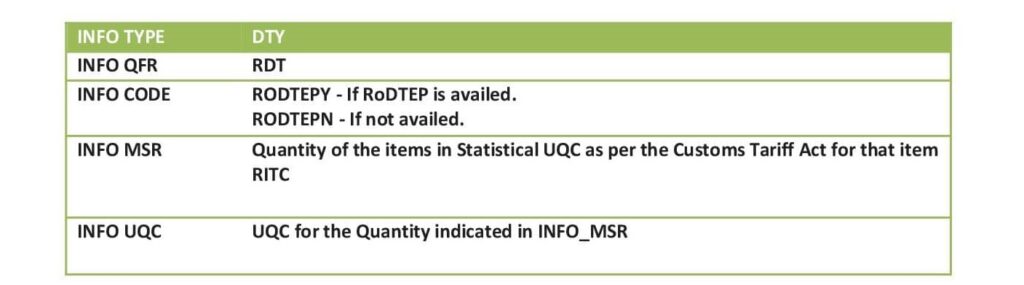

The exporter will have to make the following declarations in the SW_INFO_TYPE Table of the Shipping Bill for each item:

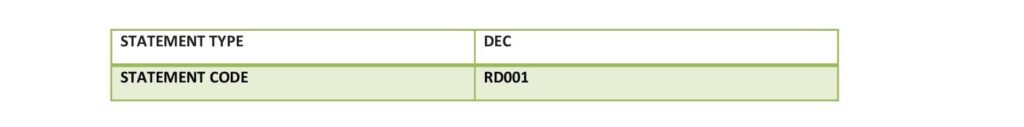

Additionally, for every item where “RODTEPY” is claimed in INFO CODE, a declaration has to be submitted in the Statement Table of the Shipping Bill as below.

RoDTEP Declaration has to be mentioned in shipping bills

ICEGate registration

The exporter has to register on ICEGate to get the login Id and Password with the help of an Email id, Mobile number, and with an Import-Export Code.

Creation of the RoDTEP Credit Ledger

To avail of the benefits under RoDTEP exporter has to create first the RoDTEP credit ledger account by logging onto the ICEGate portal i.e. using Class 3 DSC. The following information is available in the ledger account -

- Scroll Details

- Scrip Details

- Transaction Details

- Transfer Scrips

- Approved Scrips Transfer

Application procedure and scroll generation

- An application shall be filed online using a Class 3 Individual type Digital Signature Certificate on ICEGate Website (https://www.icegate.gov.in/).

- The refund under RoDTEP Scheme is in the form of electronic duty credit scrip which is transferable or can be utilized for self-consumption post-generation of Scrip.

- The RoDTEP scrolls would be generated on FIFO (First in first out) basis w.e.f. 01/01/2021.

Documents required for RoDTEP Scheme Application

The following documents have to be prepared before applying for the benefits under RoDTEP Scheme -

- Class 3 DSC

- Valid Icegate Registration with Login Id and password.

- Shipping bills

- Valid RCMC Copy

Note - Please note that E-brc is not mandatory for RoDTEP application, however, we advise all our clients to first obtain e-brc and then only apply for RoDTEP, in order to avoid any notices in the future, if any e-brc is not generated.

The last date of application for each shipping bill would be a maximum of 1 year from the Shipping Bill date or the scroll generation date whichever is later.

Rate of Rebate Under RoDTEP Scheme

- As per Notification No. 19/2015-2020, Dated 17th August 2021, the Government has announced the benefit rates for 8555 export products.

- All the eligible products with the benefit rates given under Appendix 4R notified on 17/08/2021 under notification number 19/2015-2020.

- Exporters will be given tax refunds in the range of 0.5 - 4.3 percent. The scheme would operate in a budgetary framework for each financial year and a 12,400 Cr outlay has been announced for the FY 2021-22 under RoDTEP Scheme.