MEIS Scheme (Merchandise Exports from India Scheme)

What is MEIS Scheme? - An Overview

The Merchandise Exports from India Scheme (MEIS Scheme) is an export incentive scheme introduced under the Foreign Trade Policy 2015-20, which came into effect from 01.04.2015 and will be valid until December 2020. MEIS Scheme was introduced with an objective to promote the export of goods from India by providing incentives in the range of 2-7% of the FOB value of exports for notified/specific products. By providing these incentives, MEIS Scheme aims to make Indian goods competitive in the global markets by offsetting infrastructural inefficiencies and associated costs involved in exports from India.

The emphasis is given mainly on the products which have higher export intensity, has an excellent capability to generate employment in the country and enhance the competitiveness of Indian goods in the global market.

The MEIS Scheme Provides incentive in the form of a Duty credit scrip or MEIS License which can be used in payment of import duties or can be sold in the open market for a premium rate.

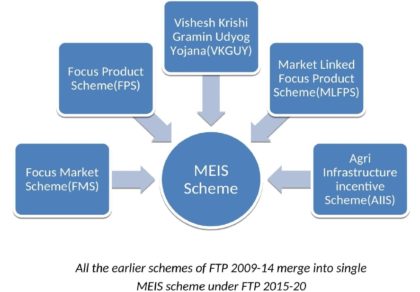

There were five schemes - Focus Market Scheme, Focus Product Scheme, Vishesh Krishi Gramin Udyog Yojana, Market Linked Focus Product Scheme, Agri Infrastructure incentive scheme under Foreign Trade Policy (FTP) 2009-14 which was replaced by MEIS Scheme. All the above five Schemes merged into a single MEIS Scheme, which removes various kinds of restrictions and significantly enlarges the scope of export incentive schemes present in earlier FTP.

The MEIS scheme benefits are permitted to exports made by Special Economic Zone(SEZ) units also, which were not allowed in the previous export incentive schemes. Exporters can avail of the benefits under this scheme on the export of the eligible goods only notified as per the Appendix 3B.

Who is eligible for MEIS Scheme?

The following is the eligibility criteria for MEIS Scheme:

- All the Exporters from India, be it a merchant exporter (trader) or a manufacturer exporter who are exporting the products that are notified in the Appendix 3B – MEIS Schedule are eligible to claim incentives under the MEIS Scheme.

- Eligibility depends only on the product exported, and not on the country of export, since as per latest circulars, MEIS Scheme is eligible for all countries.

- SEZ Units & EOU Units are also eligible to claim benefits under the MEIS Scheme.

- There is no minimum turnover criteria to claim MEIS.

- Goods exported through e-commerce platforms via courier are also eligible.

- Country of origin of the exported products should be India, re-exported products are not eligible.

- Only those Shipping Bills are eligible for MEIS Scheme in which there is a “Declaration of Intent” & Scheme reward option is ticked as “YES”.

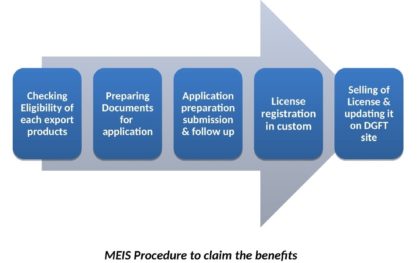

How can we assist you in claiming the MEIS scheme benefits from DGFT?

- Consult our clients about the benefits they can avail of on their products by checking their eligibility.

- We assist our clients in the preparation of documents in providing hassle-free services.

- Prepare and submit online applications to obtain the License under the MEIS scheme.

- Registration of the License done in custom from our office.

- We also assist in the selling of licenses, provide help in documentation for the transfer of a license to the buyer.

- Also, do the online transfer by recording the details on the DGFT website.

Nature of rewards under the MEIS scheme

The Incentives are given to Exporter under the MEIS scheme in the form of Duty Credit Scrip or License, which are freely transferable. In case the holder of License wishes to sell the License, he can sell them to anyone who wishes to buy the License for a waiver of their import duty.

MEIS rates

Under the MEIS scheme, the benefit is calculated as a percentage of the FOB value of export for notified goods exported into notified markets.

The incentives given under the MEIS scheme vary from product to product and from country to country. The reward rate is specified in Appendix 3B of FTP, which is categorized according to ITC(HS) code. MEIS rate of rewards varies from product to product and is in the range of 2% to 5% for most items. In some cases 7% also.

As per the recent amendment, country-wise differentiation has been done away by extending the market coverage to all countries for MEIS incentives.

Ineligible categories under MEIS scheme

There are the following export categories that are ineligible under the MEIS scheme.

- Supplies made from Domestic Tariff Area (DTA) to Special Economic Zone (SEZ) units.

- Export of imported goods covered under paragraph 2.46 of FTP.

- SEZ /EHTP/EOU/ BTP /FTWZ products exported through DTA units.

- Exports initiated by units in Free Trade and Warehousing Zones (FTWZ).

- Deemed Exports.

- Export products which are subject to Minimum export price or export duty.

- Exports through trans-shipment, meaning thereby exports that are originating in the third country but trans-shipped through India.

- Red sanders/beach sand

- Gold, Silver, Platinum

- Diamond or any other precious metal in any form and other precious and semi-precious stones.

- Crude or Petroleum products of all type and all formulation

- Cereal (all types)

- Ores and concentrate of all types and in all formations

- All Sugar type and all the form of sugar

- Export of Meat & Products of Meat

- Export of milk and it's products

How to use Duty credit scrip under MEIS?

Duty credit scrip obtained under the MEIS Scheme can be used in the payment of following Import Duties - Basic Customs Duty, Safeguard Duty, Transitional Product specific safeguard duty, Anti-dumping Duty only. It cannot be used for the payment of 18% IGST.

If the License holder does not intend to use the MEIS license for any of the given purpose then he can sell it in open market. MEIS Scrip can be sold at discount to the face value of license & can be sold directly to the buyer or through an agent who will help to find a buyer.

For example – If you have Duty credit scrip worth Rupees 2,00,000 it means it can be used to pay duties equivalent to Rupees 2,00,000. If the holder does not intend to use the scrip he can sell it in open market. The person who wishes to buy the license will not pay 100% face value of the license obtained under the scheme. He may buy the scrip for a discount @97% of face value i.e. at Rupees 1, 94, 000 instead of Rupees 2, 00, 000. But still it has the face value of Rupees 2, 00, 000 and it can be used for the payment of duties equivalent to Rupees 2, 00, 000.

In this transaction, Benefits to the buyer – He saved Rupees 6,000 in the given transaction as instead of paying Rupees 2,00,000 he only needs to pay 1,94,000. Benefits to the seller – Seller can en-cash the MEIS License and get the money directly in his account, which was otherwise of no use to him.

The Validity of the MEIS Scrip is 24 months from the date of issue. Revalidation of Duty Credit Scrip is not permitted under the MEIS scheme, and it should be valid on the date on which actual debit is made.

Documents required for MEIS Scheme Application

The following are the documents required for MEIS Scheme:

- Shipping bills

- RCMC (Registration Cum Membership Certificate)

- EBRC (Electronic Bank Realization Certificate)

Document preparation and gathering all the data needed for MEIS Application is an important task, and we have a separate team for each job to give our 100% efficiency. For submission of an online application under MEIS scheme, DGFT Digital Signature Certificate is also required.

We have an in-house team to prepare DGFT DSC and RCMC to avoid any kind of delay in the process of obtaining the MEIS License.

How to apply for MEIS Scheme / MEIS License Online? – MEIS Scheme Procedure

The Merchandise Exports from India Scheme (MEIS Scheme) is an export incentive scheme introduced under the Foreign Trade Policy 2015-20, which came into effect from 01.04.2015 and will be valid until December 2020. MEIS Scheme was introduced with an objective to promote the export of goods from India by providing incentives in the range of 2-7% of the FOB value of exports for notified/specific products. By providing these incentives, MEIS Scheme aims to make Indian goods competitive in the global markets by offsetting infrastructural inefficiencies and associated costs involved in exports from India.

The emphasis is given mainly on the products which have higher export intensity, has an excellent capability to generate employment in the country and enhance the competitiveness of Indian goods in the global market.

The MEIS Scheme Provides incentive in the form of a Duty credit scrip or MEIS License which can be used in payment of import duties or can be sold in the open market for a premium rate.

- Online Application shall be filled on the Website of DGFT (www.dgft.gov.in ) with the help of Digital Signature Certificate. Applicants need to select Online E-com Application under Services Tab from the website.

- The Online Application should be filled as per the form ANF-3A, the relevant shipping bills & e-BRC should be linked with the online Application.

- The Application can be filled with up to 50 shipping bills in one Application.

- Applicants are not allowed to manually feed the details in online applications for EDI shipments.

- Let Export Order is the date taken for determining the rate of the benefits of the products.

- The DGFT shall process the Application submitted, and Scrip shall be issued after due scrutiny of electronic documents.

- The Documents are required to be retained by the applicant for a period of 3 years from the issue date of License. DGFT may call for these original documents any time within three years.

- The above procedure is followed for claiming incentives under the MEIS scheme in all cases except in case of export of goods through e-commerce.

MEIS Scheme for export of goods through courier or foreign post offices using e-commerce

- The Goods exported by courier or foreign post office through e-commerce mode are eligible for MEIS Incentives.

- However, FOB value of goods up to Rupees 5,00,000 per consignment are only permitted for benefits under the MEIS scheme.

- If FOB value is more than Rupees 5,00,000 per consignment, then the benefit would be limited to the FOB value of Rs. Five lakh only.

- The Foreign Post Offices at New Delhi, Mumbai, Chennai are used for the manual mode of export of the goods.