TMA Scheme for Exporters (Transport and Marketing Assistance Scheme)

An Overview

Transport and Marketing Assistance (TMA) scheme is introduced by the Government of India for agricultural products. It aims to provide less expensive transportation of goods, referred to as freight, which is an integral element of today’s international trade. Under this scheme, the cost of transportation required to export some specific agricultural products has lowered. It essentially means that the Freight Cost up to a specific limit will be reimbursed by the Government to make our Agricultural products competitive in the global market. It also provides benefits for the marketing of agricultural products, which helps to promote the brands and help them attain the recognition for Indian agrarian products in the overseas markets. The TMA Scheme is included in the Foreign Trade Policy (2015-20) and was introduced on 01.03.2019.

TMA Scheme Eligibility – Who is eligible for TMA Scheme?

The scheme covers all the exporters of eligible agriculture products, registered with the relevant Export Promotion Council, as per the Foreign Trade Policy. The transport and marketing assistance scheme aims to reimburse the part amount of freight paid (sea and air) by the exporter and also the marketing costs involved in the promotion of the product. This scheme was introduced from 01.03.2019 to 31.03.2020. As per latest update, the TMA scheme has been extended till 31.03.2021.

Eligible Products under the TMA scheme

The scheme is eligible for all the export products covered under chapters 1 to 24 of theITC HS, including marine and plantation products.

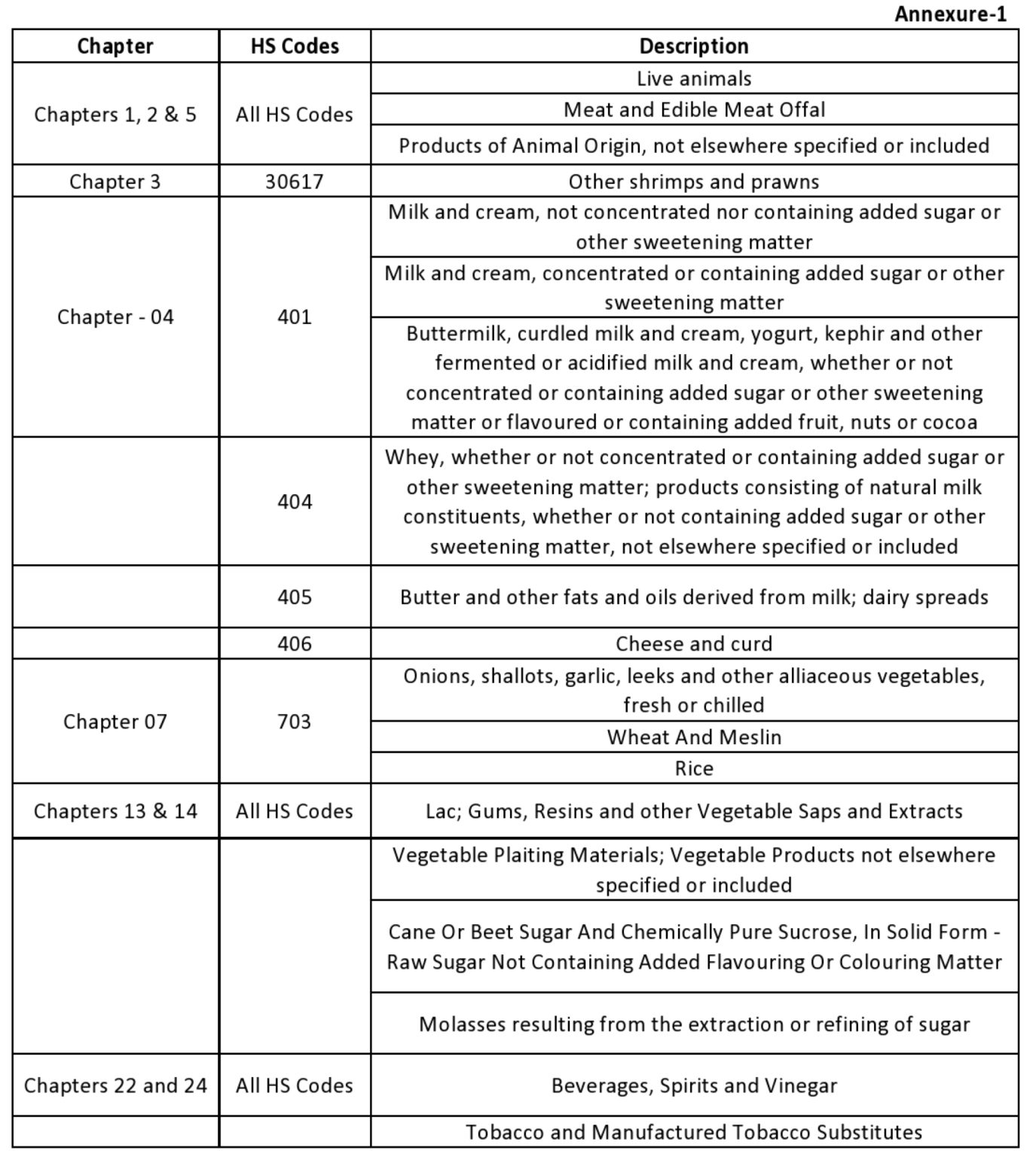

However, some specific products falling under Chapter 1 to 24 would not be covered under the Scheme for assistance. A list of such ineligible products is mentioned in Annexure (1).

List of ineligible products under TMA scheme as given below:

Coverage under the TMA scheme

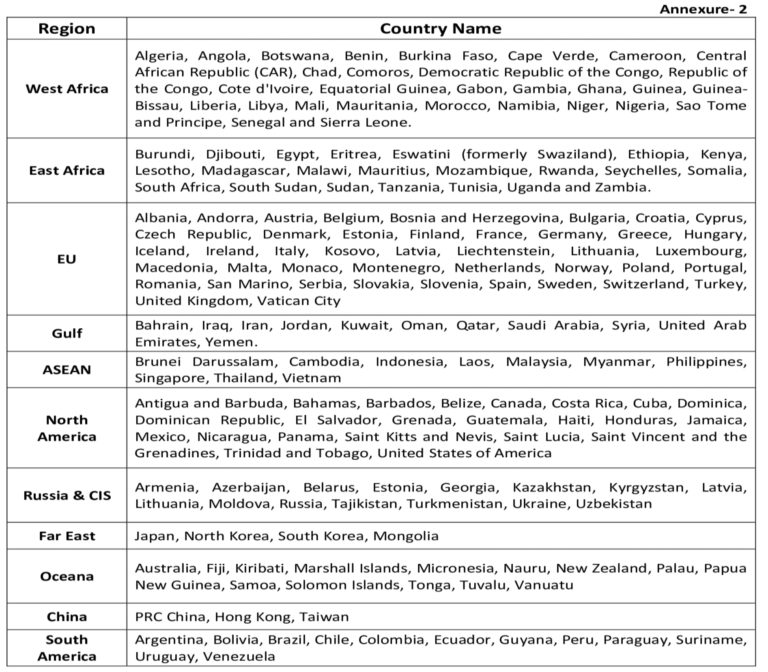

1. Export of agricultural products, to certain permissible countries as specified in Annexure (2) will only be covered under the TMA scheme.

2. The scheme covers freight transportation and the marketing for export through both ways, i.e., Air as well by sea (both regular and refrigerated cargo).

3. Annexure- 2 mentioned a list of all the export destinations/countries in each region which are available for assistance under the TMA Scheme.

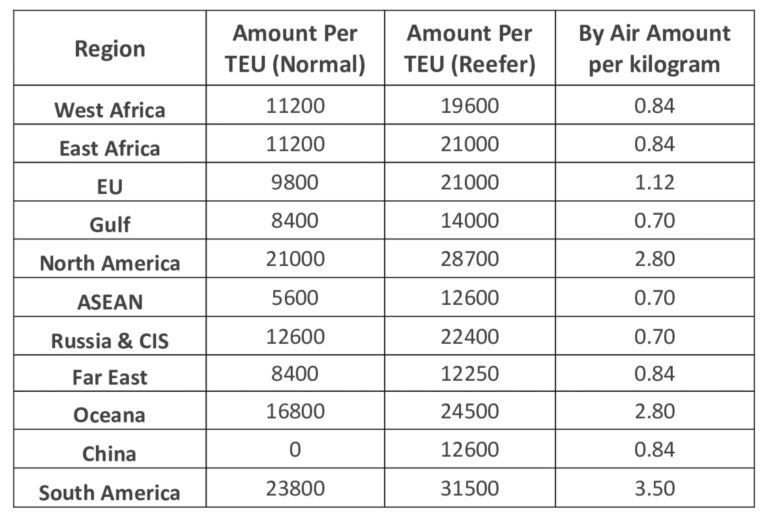

4. In Annexure- 3 mentioned, the rate of assistance is provided Country-wise.

List of Regions and Export destinations/countries in each region eligible for assistance under TMA are as under:

The assistance is provided as per the rates notified in Annexure-3.

Transport and Marketing Assistance (TMA) Scheme Annexure (3)

Differential rate of assistance under TMA (Amount in Indian Rupees)

Applicability and Important terms and conditions covered under the TMA Scheme

Applicability under TMA Scheme

- It is essential to understand that the scheme would only be applicable for the period of 01.03.2019 to 31.03.2021. That means all the Export made within the given period will be eligible for the TMA scheme.

- This aid from the Government would make a significant impact on the agriculture markets of specific products.

Important Terms & Conditions under the TMA Scheme

- The TMA scheme covers the Shipping cost based on the freight paid for Twenty-feet Equivalent Unit (TEU) containers.

- The TMA benefit will not be provided for the LCL containers, i.e., less than the container load and for a vessel that has both, eligible and ineligible cargo. TMA will not be applicable where the cargo is shipped in bulk or break-bulk mode.

- It is important to acknowledge; a forty-foot container will be considered as two TEUs (Twenty-Foot Equivalent Unit).

- The benefit in export products which are exported through the air, the assistance would be based on per kilogram.

- The assistance would only be provided under one condition, that the payment for exports is received in Foreign Exchange through normal banking channels only.

- Only the exports made through EDI ports are permissible under the scheme.

- Nature of Assistance under TMA scheme - Assistance under the scheme will be provided in cash through a direct bank transfer as a part of reimbursement of freight paid by the exporter.

- The scheme suggests that in FOB supplies, where the Indian exporter pays no freight, such exports would not be covered under this scheme.

Ineligible categories under the TMA Scheme

The below are the ineligible categories under TMA scheme:-

- Products exported from SEZs/ EOUs/ EHTPs/ STPs/ BTPs/ FTWZs

- SEZ/EOU/EHTPs/STPs/BTPs/FTWZs products exported through DTA units

- Export of imported goods covered under paragraph 2.46 of the FTP;

- Exports through trans-shipment, i.e., exports that are originating in the third country but trans-shipped through India;

- Exported items are restricted or prohibited for export under Schedule-2 of Export Policy in ITC (HS) unless specifically notified.

- Export of goods through courier or foreign post offices using e-Commerce

Documents required for claiming benefit under the TMA Scheme

For an online application under the Transport and marketing Assistance (TMA) Scheme, below is the complete updated list (2020) of all the documents required for the TMA application.

- Import Export Code (IEC Code)

- Registration-Cum-Membership-Certificate (RCMC)

- Shipping Bill Copy

- E-BRC

- Commercial Invoice

- Bill of Lading, in case of Shipment by Sea

- Airway Bill, in case of Shipment by Air

- TMA Application Form- ANF- 7 (Part- A & Part- B)

- Certificate of Chartered Accountant (C.A.)/ Cost and Works Accountant (ICWA)/ Company Secretary (C.S) as per Annexure A to ANF- 7(A)A

- Pre-receipt.

Procedure to apply under TMA scheme – How to apply under TMA scheme for Exporters?

- The Application has to filed by registered exporter having valid RCMC.

- The applicant has to Choose option of “RA’s” headed by Additional DGFT while making 1st application, and there would be no changes allowed for further claims.

- Applicants have to make an application on a quarterly basis within one year from the completion of a quarter in a single bunch. There are no late cut provisions applicable for this scheme.

- The Shipping bills, E-BRC's, Bill of Lading, and CA Certificate are the documents required for physical submission.

- The applicant has to submit a physical PDF copy of ANF 7(A) A with prescribed documents, and it has to be filed manually with RA within 30 days.

- The Non-submission of a physical copy of the application with prescribed documents within 30 days after filing online application, the incomplete or deficient application shall result in non-acceptance; therefore, the application shall be rejected.

- Public notice 02/2015-20 Dated 13th April 2020, DGFT has given one-time relaxation for submission of physical documents. As per the public notice, the application filed online on or after 01.02.2020 upto 30.09.2020, physical copy of ANF- 7(A) A along with prescribed documents can be submitted manually to DGFT RA upto 30.10.2020.

How can we assist you in claiming TMA Scheme benefits?

We are leading Import Export (DGFT Consultants) having a client-base across India. We provide all the services related to DGFT, including MEIS, EPCG, SEIS, Advance Authorisation, DFIA, RoSCTL scheme, TMA scheme, RoDTEP scheme, etc.

While applying for the TMA application, the below table will help you to know the steps that how we can help you to claim TMA benefits.

- Step-1: We collect the documents from you like Shipping bills copies, E-BRC’s, Commercial Invoices, Bill of Lading, or Airway Bills Copies.

- Step-2: Our Team will work on the documents and prepare the online application.

- Step-3: After the preparation of the online application, the online copy will be mailed to you for confirmation.

- Step-4: Once the online application is approved from you, we will submit the online application. And will send you manual documents for signing purposes.

- Step-5: Once the Hard copy of documents is received from you, we will submit it at DGFT and take regular follow-up with DGFT.

- Step-6: Once DGFT approves the application, DGFT gives the Pre-receipt copy. We will share the print with you and take regular follow-up with DGFT till the benefit amount is credited to your account.