Star Export House Certificate / Status Holder Certificate

Latest News on Star Export House Certification

Automatic System based Issuance of E-Status Holder Certificate/Star Export House Certificate [E-SHC]

In the interest of trade facilitation, reducing compliance burden and promoting ease of doing business, it is decided to Grant electronic Status Holder Certification, based on Merchandise export data available with DGCI&S. Exporters need not file any application for the same.

This facility of automatic issuance of E-SHC will not be available in the case of Services exports, Deemed Exports and Double weightage cases. Also in cases where the IEC Holder requires upgradation with higher status, in such cases also online application is to be done. [i.e. Automatic Facility will not be available]

Trade Notice No. 28/2023-24 clearly states that all the Star Export house Certificates issued before 1st April 2023 will be valid only till 30th September 2023. Post that if the IEC Holder did not get his E-SHC automatically then application is to be done as per the normal procedures. All existing Certificates will be void after 30th September 2023

The e-SHC will be made available after necessary IT iterations, by 15th August every year. Eligible exporters will be automatically issued e-SHC within 48 hrs of the issue of the Trade Notice.

All pending/in-process applications under FTP 2023 will be scrutinized by the IT System for Auto Issuance.

An IEC Holder who is not getting covered under the new mechanism of automatic issue, will need to apply online to concerned RA of DGFT as per HBP 2023 provisions.

This will certainly be a welcome step for all exporters.

Overview

The main objective of foreign trade policies is to make the import-export process simple and attractive for importers, exporters, and traders. There are various export promotion schemes, and Status Holder Certificate is one of them. The Objective of the Export House Certificate or Status Holder Certificate is to boost export performance. As per the updates to the Foreign Trade Policy of 2015-2020, exporters are assigned status holder positions by their export performance. If you have attained a leadership position in your business niche and have an excellent track record of international commerce, you can be a Star Export House. You must have also made significant contributions to India's foreign trade. Furthermore, you must agree to undertake the mentoring of upcoming Indian entrepreneurs and thus help strengthen India's export-related commerce.

Eligibility Criteria

There are the following eligibility criteria to recognize an exporter as a “status holder exporter”:

- The applicant for the grant of Star Export House must have the Import – Export Code (IEC).

- The certificate is given depending upon the certain level of export performance achieved by the exporters.

The applicant can get status holder recognition in any of the five categories from One Star Export House to Five Star Export House. Your export performance FOB/FOR value for them should be $3 million, $15 million, $50 million, $200 million, and $800 million, respectively.

Categories and the export criteria to get Status Holder Certificate

As per the image, you can see that there is no change in the criteria of One Star Export House.

In another update to Star Export House Policy, exporters of fruits and vegetables are made eligible for double weightage status in addition to MSME units. That is, if the exports of Fruits and Vegetable exporters in the last 3 plus current financial years are USD 1.5 million, they can still claim 1 Star Export House.

The above Export performance is to be achieved in the current plus previous three Financial Years. For Example, if You were applying for Star Export House Certification in July 2019, then your total Export Turnover for the Current FY (i.e., April to July 2019) plus the previous three FY (i.e., 2016-17, 2017-18 & 2018- 19) should be $ 3 million to be eligible for One Star Export House Certification.

Important Notes:

Turnover of only those shipments can be counted for which e-BRC has been generated.

Export performance in at least two out of the four Financial Years is compulsory to get Star Export House Certificate.

The DGFT does not recognize exports made on a re-export basis.

For the export performance, the DGFT will consider the Free on Board (FOB) value of export earning in free foreign exchange. In the case of deemed exports—that is, transactions involving goods that remain in the country and which are paid for either in Indian or foreign freely convertible currency —the DGFT will take into account the FOB/FOR value of the exports after it is converted from Indian rupees to US dollars. For this conversion, the exchange rate will be declared by the Central Board of Excise and Customs (CBEC) on 1st April of the Financial Year.

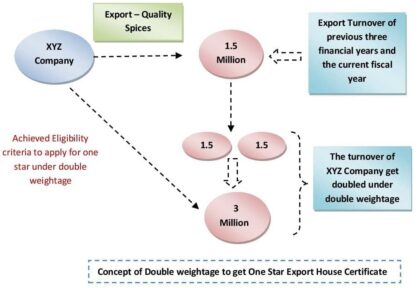

Concept of Double weightage to get One Star Export House Certificate:

The criteria for receiving double weightage applies to the only one-star export houses. This does not apply to other status holder categories.

An exporter who meets any one of the following criteria can get double weightage benefit:

- Micro, Small and Medium Enterprises (MSME) as defined in

Micro, Small and Medium Enterprises Development Act, 2006 - Manufacturing units that operate as per the ISO/BIS standards,

- Business units situated in Sikkim, Jammu & Kashmir, and other

northeastern states - Business units situated in the Agri Export Zones.

Only one-time double weightage is allowed for a shipment in given categories.

For example:

XYZ farms produced export quality Spices. Their combined annual turnover for the previous three financial years and the current fiscal year was 1.5 million dollars. The minimum turnover required for the One-star Export House category is 3 million dollars. However, They had an MSME/SSI Certificate. In such a case, they can be granted a double weightage benefit. So with the grant of double weightage, their turnover of 1.5 million will now be calculated as 3 million dollars (1.5 x 2=3), and thus they will be granted the Status Holder Certificate of One Star Export House.

Benefits

Standard Input-Output Norms (SION)

- Norms fixed under Advance Authorization/EPCG License within 2 months on a priority basis by the norms committee.

Exemption from the furnishing of Bank Guarantee (BG)

- The Status Holders are 100% exempted from the furnishing of Bank Guarantee (BG) under the Advance/EPCG Scheme.

Establishment of Export Warehouse

- As per the Department of Revenue (DoR) guidelines, 2 star and above status holders shall be eligible to establish Export Warehouses.

Export of free-of-cost samples

- Status Holders/Star Export houses are entitled to export freely exportable items on a free of cost basis for the export promotion purpose subject to the annual limit as specified (Excluding Gems and Jewellery, Articles of Gold and precious metals).

Self Certification

Three Star/Four Star/Five Star status holders (Manufacturer Exporters) will be enabled to self-certify their manufactured goods as originating from India (Certificate of origin) to qualify for preferential treatment under following

- Preferential trading agreements (PTA),

- Free Trade Agreements (FTAs),

- Comprehensive Economic Cooperation Agreements (CECA)

Comprehensive Economic Partnership Agreements (CEPA).

Ease in Documentation and Preferential treatment

- Compulsory negotiation exempted for export documents through banks and entitled to preferential treatment and priority in the handling of import-export consignments.

Financial assistance

- There are various Government Schemes under which status holders are given access to loans easily.

Validity of Status Holder Certificate:

The Ministry of textile (MoT) has announced an additional AD-HOC Incentive of 1% on Free-On-board Value (FOB).

- Status Holder Certificate or Export House Certificate shall be valid for 5 Years from the date of issue of the certificate.

- Certificate renewal shall be filed before the expiry of the existing validity period.

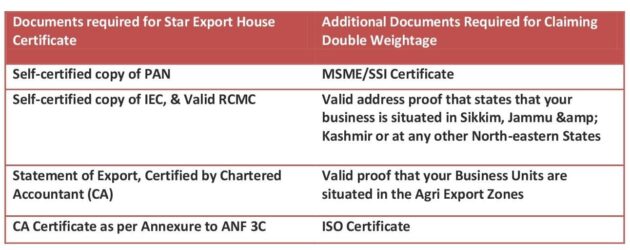

Documents required for Star Export House Certificate

Documents required for Star Export House certificate

There are the following documents required for Star Export House Certificate(given in the first column). For claiming the benefit of Double Weightage to get one-star export house status, you will need any one of the additional documents from the 2nd column:

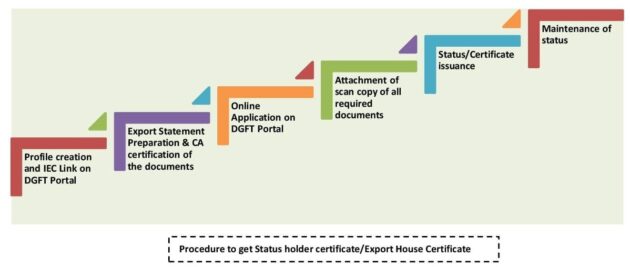

Export House Certificate Application Procedure

Pre-requisites to do the Application on DGFT Portal

- DGFT Profile must be linked with IEC.

- Valid DSC token has to be registered in the system, (Verify from My Dashboard > View and Register Digital Signature Token)

- Export Turnover must be updated in the IEC profile on the DGFT portal

Application on DGFT Portal

- The Application procedure for the status holders is designed to be paperless and contactless to grant the status.

- The applications are required to be submitted online on the DGFT website through the importer/exporter's dashboard.

- The application shall be filed along with the Application form ANF -3C with the help of a Digital Signature Certificate.

- All the required details shall be filled in ANF 3C, CA Certificate as per annexure, an export statement certified by a chartered accountant, Self Certified copy of IEC, Valid RCMC, and pan card needs to be scanned and uploaded online.

- Any communication, correction, clarification, as well as approval of submitted applications, are electronic from 22.02.2021 onwards.

- There is no Government fee required to submit for the Export House Certificate

- No Physical submission of the document is required.

Maintenance of Accounts:-

- Export house/Status holder should maintain true and proper accounts of imports and exports based on which certification has been granted by the DGFT.

- It has to be maintained for 2 years from the issuance date of the Status certificate.

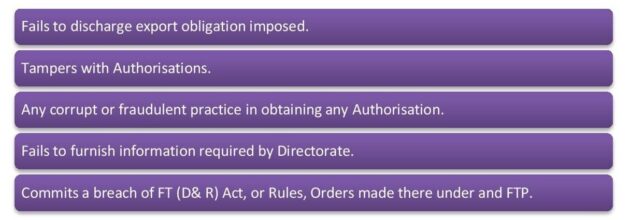

Cancellation/Suspension of Certificate

The status granted under star export house may be canceled/suspended by the concerned RA, if the status holders are found to be in the following cases. Before taking any action a reasonable opportunity is given to them by the DGFT.

Reasons for Cancellation of Status Certificate

Renewal of Status Certificate

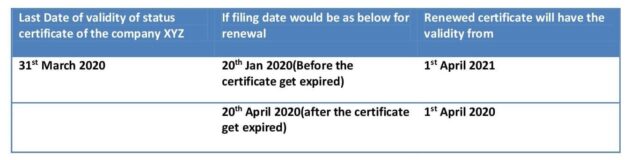

- If the Status Holder files the application for renewal before the expiry of the certificate, the renewed certificate will have validity commencing from 1St April of next licensing year.

- If the Status Holder files the application for renewal after the expiry of the certificate, the renewed certificate will have the validity commence from 1st April of the year during which the application was filed.

Explanation of Validity Period for Renewed Certificate

How can we assist you in getting Star Export House / Status Holder Certification?

- We are leading Star Export House Consultants in India.

- We assist our client in the compilation of exports made in the present FY plus the last three financial years export and analyze to check the eligibility for getting a certificate.

- Accordingly, prepare the application along with the documentation.

- Submit the application online & coordinate with DGFT till issuance of the Status Holder Certificate.

- Guiding Clients in taking advantage of the various privileges given to Star Export House Holders.