India UAE CEPA – Eligibility, Rules of Origin & Procedure to get CoO from DGFT

ALL ABOUT - INDIA UAE CEPA TRADE AGREEMENT

In this page we will discuss all the important Points you need to know about the recently announced India-UAE CEPA Trade Agreement.

You will get all the information in this like - Is the Agreement beneficial for you? Which products are eligible? What are the rules or origin? How can you apply for CoO under this Free Trade Agreement? Where to apply? What are the documents required? What are the obligations on the part of the exporter? Etc. Please read the information till the end.

1. Background of FTA Agreements, What is CEPA & Why it is so important for Exports?

We are aware that FTA (Free Trade Agreement) gives preferential tariff access to Indian Export products in the Importing country.

One such FTA is recently announced India UAE CEPA. India UAE CEPA was signed on 18th February 2022, and has become operational since 1st May 2022.

So why is this FTA so important? - Because the UAE is a gateway to Africa, many other gulf countries and Europe & 90% of India’s exports in value terms would immediately become completely duty-free.

So this will be very beneficial for Indian exporters.

2. Which sectors or which export products are eligible for concessional duty?

The list of all such products HS code-wise is given in ANNEX 2B. The link of the PDF file is shared below.

[Link - https://commerce.gov.in/wp-content/uploads/2022/03/Chapter-2-Annex-2B-Final-UAE-Revised-Market-Access-Offer-2118-Dec-18-2021.pdf]

In the list, the majority of the export products are given 0% duty benefit immediately, whereas some products will get 0% duty benefit in a phased manner i.e. after 5 years or 7 years or 10 years.

3. What are the Rules of origin criteria?

So the rules of Origin are a very important section. A product will be considered of Indian origin only if it is wholly obtained in India or Sufficient Processing or working on the imported materials is made to arrive at the Final product.

We will understand each By way of an Example:

Wholly obtained in India means the products that are entirely grown in India or manufactured using 100% Indian raw materials. A common example of such products would be fruits & vegetables that are grown in India.

So the 1st criteria is pretty simple and clear.

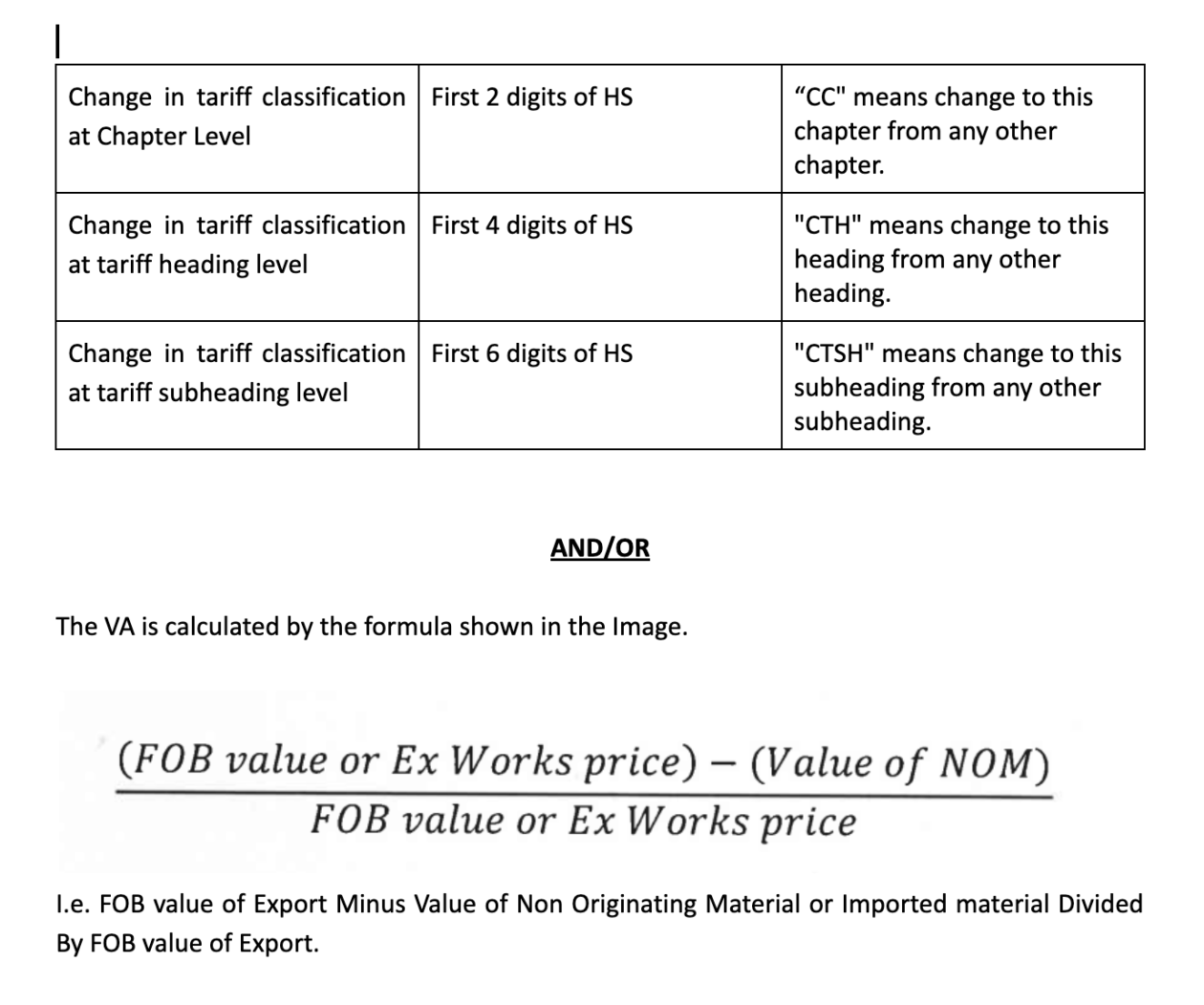

Regarding the 2nd Criteria, a product will be considered sufficiently processed if it undergoes change in tariff classification at Chapter Level i.e. First 2 digits of HS/tariff heading level i.e. First 4 digits/tariff subheading level i.e. First 6 digits AND/OR it satisfies the Value addition criteria. This will be explained in detail in the Product Specific Rules section.

4. Products Specific Rules (PSR)

Let us understand these rules by way of 3 Examples.

Example 1 –

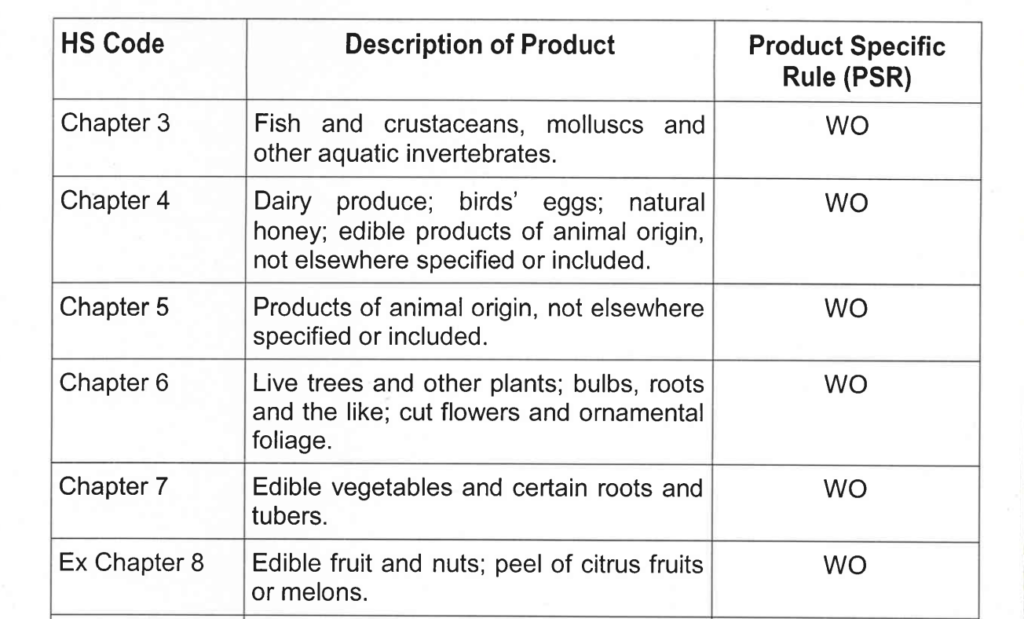

The Image shows that for any product under Chapters 3 to 8, to qualify under the CEPA benefits, it should compulsorily be wholly obtained i.e. “WO” Example 2 -

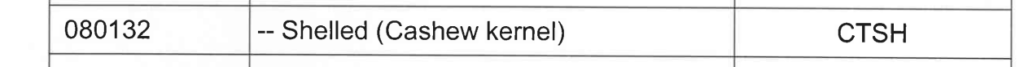

So in this example the export product i.e. Cashew kernel will qualify for the CEPA benefits only if it has undergone a change in CTSH i.e. Tariff subheading level i.e. First 6 digits of imported Raw material is different from First 6 digits of the final export product.

Example 3 -

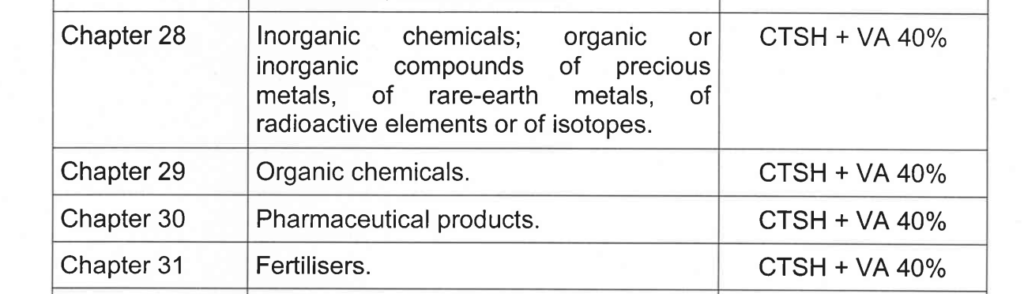

The Image shows that for any product under Chapters 28 to 31, to qualify under the CEPA benefits, it should compulsorily maintain both the conditions i.e. CTSH i.e. First 6 digits of imported Raw material should be different from First 6 digits of the final export product + 40% VA should be maintained.

If there are many export items in the Invoice then VA for each export item should be calculated separately. Maybe it is possible that some of your items are not fulfilling the PSR criteria, then in those cases you have to mention that in your documents & CEPA benefits for those products should not be taken.

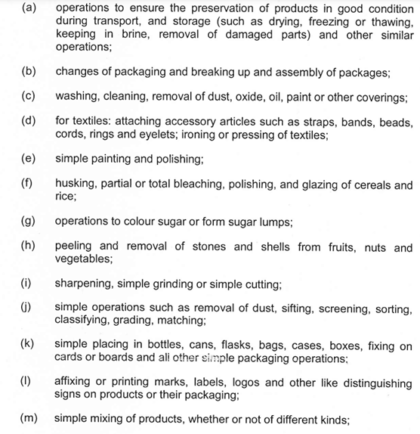

5. Minimal process or insufficient operations

The below Image shows the list of processes that are not allowed. It means that if you are importing something and doing any of the above processes & exporting it, then it won’t qualify for CEPA benefits.

6. How to apply For CoO under CEPA?

So the last question would be how and where to apply?

Application for CoO under CEPA is to be done on the CoO common digital platform. It is a compulsory online process.

The application should be filed within 5 days from the date of export to the nearest Export Inspection agency or DGFT.

A common set of documents required are as follows:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

Once the application is done the CoO is issued within one to two working days.

7. Who Are We and Why Choose Us

we are well-equipped to handle the logistics of global trade with efficiency and expertise. Let us handle the logistics while you focus on growing your business. Contact us today to learn more about how we can help you streamline your supply chain and increase your bottom line. We are dedicated to providing efficient and cost-effective logistics services to help our clients.

So do get in touch with us for any of your requirements and our team will be happy to help you.

We request you to share this information with your other Industry friends, Trade associations, as this information might help them as well.