India Australia Economic Cooperation and Trade Agreement [ECTA]

Preferential CoO under India Australia [ECTA] Agreement

We will discuss about the recently announced India Australia Economic Cooperation and Trade Agreement, widely known as India Australia ECTA.

This agreement covers a variety of topics such as duty free access to Indian export products, cooperation in services, student work visas, opportunities for Indian chefs and yoga instructors, etc.

As per Union Minister Shri Piyush Goyal, It is expected that the current bilateral trade of 31 Billion USD may reach 45 to 50 Billion Dollars in the coming 5 to 6 years.

In this page we will look at this agreement from the perspective of Indian goods exporters and see how this trade agreement can benefit them to expand their business in Australia. You will get all the information in this page like - Is the Agreement beneficial for you? Which products are eligible? What are the rules or origin? How can you apply for CoO under this Free Trade Agreement? Where to apply? What are the documents required? What are the obligations on part of the exporter? Etc. So let’s get started.

1. India Australia Free Trade Agreement Benefits?

We all know that FTA gives preferential tariff access to Indian Export products in the Importing country.

One such FTA is recently announced India-Australia ECTA. Ind-AUS ECTA was signed in April 2022, and has become operational since 29th December 2022.

So why is this FTA so important? - Over 96% of India’s exports to Australia by value will be getting duty free access under the India Australia Economic Cooperation and Trade Agreement immediately from the start date of this agreement. And remaining product lines getting duty free access gradually in the coming 5 years

Most Textiles and Apparel, Some agricultural, fisheries products, leather, footwear, furniture, sports goods, jewellery, machinery, electrical goods, railway wagons, also select pharmaceutical and medical goods will be among the biggest beneficiaries of this trade agreement.

Australia on the other hand is a supplier of raw materials and intermediates, minerals and things like that, which are very useful for the Indian Industry, because if our raw materials are cheaper then the final product is also cost competitive in the world markets. So this agreement is a win-win situation for both the countries.

2. India Australia Free Trade Agreement Products List?

The list of all such products HS code wise is given in ANNEX 2A - Schedule of Australia. The link of this PDF file is shared below -

This list shows HS Code, Product Description, base rate and the Staging category. The Staging category is of two types i.e. A & B5

Staging Category A means there will be 0% Import duty in Australia from 29th December 2022 itself.

Staging Category B5 means there will be 0% Import Duty in Australia at the end of 5 years, and every year the import duty will be reduced in equal installments.

Let us understand this by way of an example, please see the table below

| HS Code | Description | Base rate | Staging category |

| 6302.12.10 | Curtains | 5% | A |

| 7208.10.00 | FLAT-ROLLED PRODUCTS OF IRON OR NON ALLOY STEEL, -In coils, not further worked than hot-rolled, with patterns in relief | 5% | B5 |

(Example of products with category)

In this table it can be seen that “Curtains”, which currently has an Import duty of 5%, will immediately become 0 from 29th December 2022.

And “Flat rolled products” under chapter 7208 which currently has an Import duty of 5%, will be reduced in equal installments i.e. 4%, 3%, 2% and so on and it will eventually become zero by the end of 5 years.

3. What are the Rules of origin criteria?

So the rules of origin is a very important section. A product will be considered of Indian origin only if 1. It is wholly obtained or Produced in India or 2. Produced entirely in India using non-originating materials [i.e. imported materials]

We will understand each By way of an Example:

Wholly obtained in India means the products that are entirely grown in India or produced using 100% Indian raw materials. A common example of such products would be fruits & vegetables that are grown in India.

So the 1st criteria is pretty simple and clear.

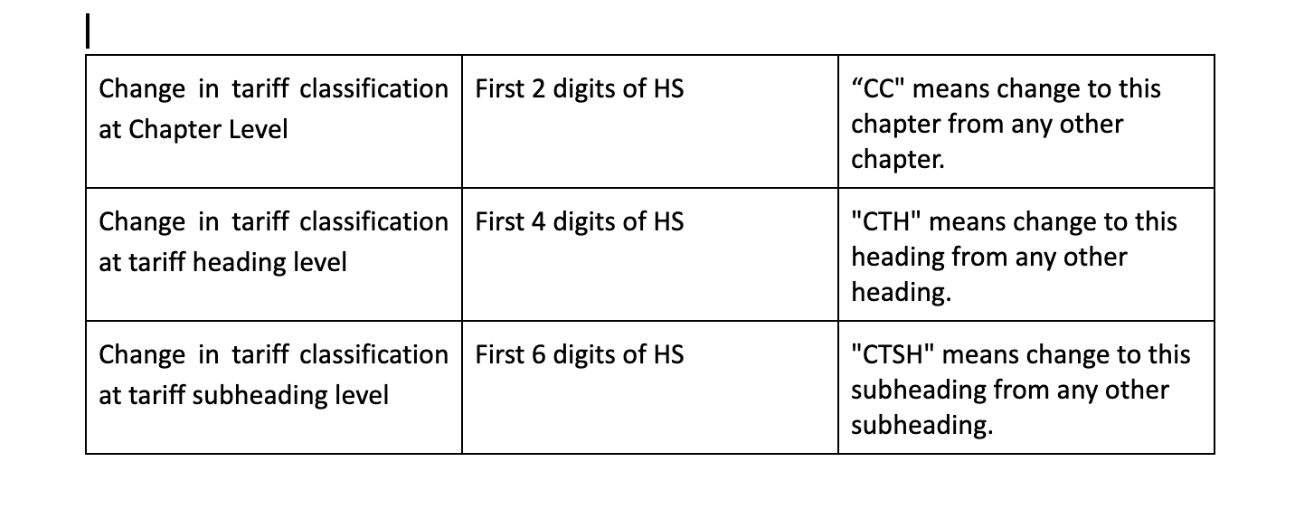

Regarding the 2nd Criteria, a product will be considered as originating from India if it undergoes change in tariff classification at Chapter Level [CC] i.e. First 2 digits of HS / tariff heading level [CTH] i.e. First 4 digits / tariff subheading level [CTSH] i.e. First 6 digits AND/OR it satisfies the QVC [Qualifying Value Content] criteria. This will be explained in detail in the Product Specific rules section.