Advance Authorisation Scheme (Advance License Scheme)

An Overview

Advance Authorisation Scheme (AAS) or Advance License Scheme is a type of duty exemption scheme introduced by the Government of India under the Foreign Trade Policy 2015-2020. Under this scheme, exemption from the payment of import duties is given to raw materials/inputs required for the manufacture of export products i.e., you can import raw materials/inputs at zero customs duty for the production of export products. The purpose of this scheme is to make India’s products competitive in the global market. When duties paid on raw materials are saved, it automatically brings down the cost of the final export product.

What can be imported duty-free under Advance Authorization Scheme?

In the Advance Authorisation Scheme, the exporter can import raw materials duty-free. As per Chapter 9 of FTP para, 9.44 “Raw material” means input(s) required for the manufacturing of goods. These inputs either can be in a raw/natural/unrefined/unmanufactured or manufactured state. Hence, Advance License is issued to allow duty-free import of inputs, which is physically incorporated in export products (after making normal allowance for wastage). In addition to this, fuel, oil, the catalyst which is consumed/utilized in the process of production of export product, may also be allowed.

Duties Exempted under the Advance Authorisation Scheme.

Imports under Advance License are exempted from the payment of Basic Customs Duty (BCD), Additional Customs Duty, Education Cess, Anti-dumping Duty, Countervailing Duty, Safeguard Duty, Transition Product Specific Safeguard Duty, wherever applicable. Under the Advance Authorisation, imports for physical exports are also exempted from the whole of the integrated tax and Compensation Cess and such imports shall be subject to pre-import condition. Imports against Advance Authorisations Scheme for the physical exports are exempted from Integrated Tax and Compensation Cess up to 31.03.2020 only. As per Notification No. 57/2015-20 dated 31.03.2020, this exemption is renewed till 31.03.2021.

Eligibility Criteria for Advance Authorisation Scheme DGFT.

Since Advance Authorisation Scheme comes with an actual user condition, it can be issued to either manufacturer exporter or merchant exporter tied with a supporting manufacturer.

As per the Para 4.05(c) of the FTP, Advance Authorisation is issued for:-

- Physical Export (including Export to SEZ).

- Intermediate Supply, i.e. supply to someone who is holding an Advance

License. - Supply of goods- Deemed exports.

- Supply of ‘stores’ on board of foreign going vessels/ aircraft.

What is the Advance License for Deemed Exports?

- Deemed Export: Deemed Export refers to the supply of finished goods that do not leave the country, and the payment of transaction can be in INR or free foreign exchange.

- Following are the categories of supply that are considered as Deemed Exports:

- Supply of goods to EOU / STP / EHTP / BTP units.

- Supply of goods against Advance Authorization / Advance Authorization for

annual requirement / DFIA - Supply of Capital Goods/Machinery against EPCG Authorization.

- Supply to other Government Funded projects, etc.

- One can apply for an Advance License for Deemed exports from the DGFT office.

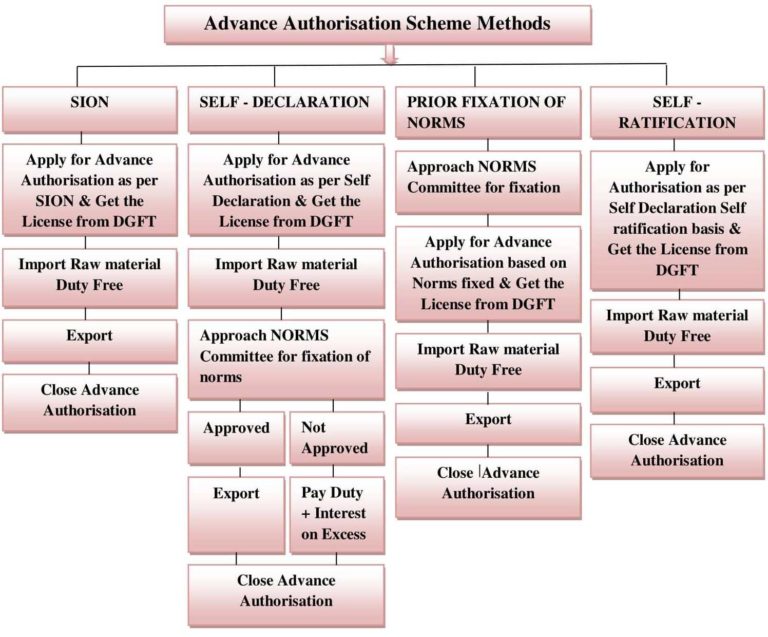

Methods for issuing Advance License.

An exporter can apply for fresh Advance Authorisation by four ways-

- SION (Standard Input and Output Norms).

- Based on Self-Declared Norms, to be approved subsequently (Under Para 4.07 of HBP, Ad-hoc Norms).

- Applicant Specific Prior-Fixation of Norms by the Norms Committee.

- Based on Self-Declaration & Self-Ratification. (Self-Ratification Advance Authorisation Scheme).

Standard Input-Output Norms (SION Norms)

Under this method, Norms for thousands of products falling under different segments like Chemical and allied products, Electronics, Engineering, Food products, Handicrafts, Leather, Plastics, Sports, textile, etc. are pre-fixed. In this method, you apply for Advance Authorisation License under the said Sr.NO. of SION and get the license from DGFT.

Self-Declared Norms

Under this method, an exporter can apply for an Advance Authorisation License on a self-declaration basis, if the required export product is not there in the SION or he is not satisfied with Import Quantity allowed. Here, he will select the Import Items and Quantity of Import Items as per his requirement. In this method, Applicant has to apply to the Norms Committee (DGFT Delhi) for fixation of Ad-hoc Norms and get the Norms Ratified. The advance License will be closed only if the norms are ratified/approved by the Norms Committee. However, if the applied norms are not accepted by the Norms Committee, then the applicant has to pay Customs Duty + Interest on the excess import quantity and close the Advance License.

Applicant Specific- Prior Fixation of Norms

Under this method, you have to first approach the Norms Committee and get the norms fixed/ratified. Only then DGFT will issue an Advance License based on the fixed norms. Rest all the procedure remains the same.

Self-Ratification Advance Authorisation Scheme

Fixation of Norms used to consume a lot of time & money. Hence keeping in mind the ease of doing business of the Government of India, DGFT introduced a new method known as the Self ratification Advance Authorisation Scheme. Under this method, Advance License will be issued by the DGFT on a self- declaration basis, but there is no need to approach the Norms Committee in Delhi to ratify your norms. It is assumed to be self ratified, and no further questions will be asked. However not all the exporters are eligible for this scheme, there are some conditions, please find them below:

- Only Exporter (either merchant or manufacturer) who holds an AEO Certification (Authorized Economic Operator) is eligible to opt for this scheme.

- The scheme shall not be available for all export products covered under Chapter 1 to 24 & Chapter 71 of ITC HS, etc.

- Inputs imported or locally procured shall be subject to pre-import condition. i.e., Inputs should be imported and physically incorporated in the export product before exports take place.

- An audit may be conducted by DGFT or any authorized person.

- If the result of the Audit points to any mis-declaration and/or it is detected that the inputs claimed are not used in the manufacturing process, or excess Qty of inputs is claimed than originally required/consumed. In such cases, demand and recovery actions will be initiated.

Documents required for applying for an Advance license from DGFT

Documents for filing Advance Authorisation application depends as per the above four methods. Please find below basic Important documents required-

- DGFT DSC.

- Copy of IEC.

- Application form ANF – 4A.

- Copy of SSI/IEM/MSME

- Copy of Export House Certificate (if applicable)

- Copy Valid RCMC

- Copy of GST Certificate.

Advance License scheme procedure

Please find an image below which explains all the above four methods in a simple and easily understandable manner-

Please find below procedure for online application of Advance Licence:

- Prepare documents as per the above-mentioned list of documents.

- Visit the DGFT Official Website- www.dgft.gov.in.

- Login with DSC & Select Services from Online Ecom Application.

- Click on Advance Authorisation (DES).

- Fill all the details and upload the necessary documents.

- Kindly note that the following important points to be noted to make sure the

documents are prepared error-free:- IEC/RCMC should show the applicant as a manufacturer exporter.

- IEC/RCMC should have the address where the raw materials are proposed to

be taken for processing. - MSME/SSI/Manufacturing proof should have the export products listed in the

Advance License.

- After filling all the details, submit the application.

- After a successful application, DGFT will issue the Advance License.

How can we assist you for Advance Authorisation Scheme?

Our experts assist you in getting Advance License Benefits from DGFT & Customs as under:

- We help you in preparing documents for application of Advance License.

- Obtaining Advance License from Director General of Foreign Trade.

- Guiding regarding the procedural requirement & Compliances to be followed by the Client after issuance of Advance Authorization.

- Obtaining Amendment, Enhancements or Extension for the Advance License.

- Getting Redemption Letter from DGFT RA and release of Bond after fulfilling the export obligation from Customs.

Important Terms & conditions under Advance Authorisation Scheme.

The benefit under Advance Authorisation scheme comes with certain terms and conditions, please find them below:

- Items prohibited for exports or imports are not allowed under AA.

- AA is issued Subject to Actual User Condition.

- Inter Unit Transfer of Inputs permitted.

- 15% is the minimum Value Addition to be achieved.

- Certain products have less/more Value Addition.

- Certain categories of Inputs are ineligible for benefits.

- Free of cost Material permitted for imports.

- Duty Drawback shall be available for only duty paid inputs used. (All Industry Rate of Drawback will not be available)

- Import of restricted items shall also be allowed under Advance Authorisation (AA) Scheme.

Actual User Condition under Advance Authorisation Scheme.

The material imported under Advance Authorisation shall be subject to the “Actual User” condition. It means that the material cannot be transferred and it has to be used in the premises of the License holder only. It is not transferrable even after the completion of Export Obligation (EO). However, the Advance License holder will have the option to dispose of/sell products manufactured out of duty-free input once the Export Obligation is completed.

Pre-Import Condition under Advance Authorisation Scheme.

It means that the raw material should be imported first; physically incorporated in the export product and then the export should take place. You cannot export first using the duty paid material that you have and then Import raw material duty-free. This is not allowed. Items that have the pre import condition have been indicated in Appendix 4J or SION Norms List.

Invalidation Letter under Advance License.

In case the exporter does not want to import directly under Advance Authorisation, i.e. he wants to procure raw materials indigenously from a domestic supplier. Then he/she needs to invalidate the Advance License for direct import and obtain the Invalidation letter from DGFT. Invalidation Letter is issued by DGFT RA at the time of Advance Authorisation or subsequently. The validity of the Invalidation letter is co-terminus with the validity of Advance Authorisation.

Redemption of Advance License / EODC.

On completion of the imports and exports, the license holder shall submit an application in ANF-4F for the Redemption of the Advance Authorisation License. The Regional Authority of DGFT will verify the completeness of the Application in all aspects. If Export Obligation (EO) and other conditions have been successfully fulfilled, the Regional Authority (RA) will issue the EODC (Export Obligation Discharge Certificate)/ Redemption Certificate to the Authorisation holder.