Authorized Economic Operator (AEO)

An Overview

The Authorized Economic Operator (AEO) is the status certification granted to an economic operator after fulfilling certain eligibility criteria. In 2001 the US terror attack 9/11 has made the World Customs Organization realize that the international supply chain could be used for terror activities and need to be secured. In 2005 the WCO created the SAFE Framework of Standards (FoS) to Secure the international supply chain which includes the AEO.

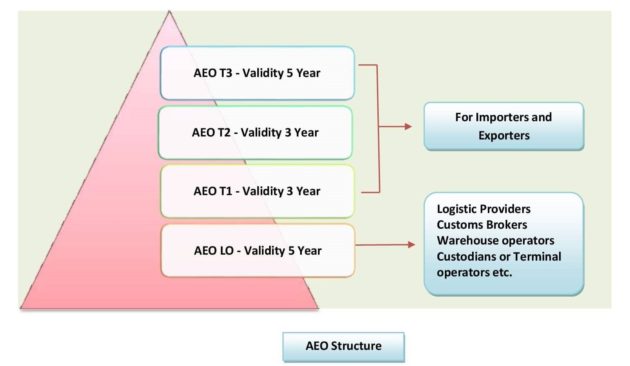

Indian AEO Programme was launched by the Government on 23rd August 2011 and aims to enhance international supply chain security and facilitate the movement of legitimate goods. There are three-tier AEO Programme ie AEO T1, AEO T2, AEO T3 for importers and exporters in increasing degree of benefits and single-tier AEO LO for Logistics Providers, Custodians or Terminal Operators, Customs Brokers and Warehouse Operators.

[Refer to the below image to get a complete idea about the AEO structure and the validity of each AEO Tier]

Why we need AEO Certification??

If you are a business owner, you would always need some form of recognition to showcase your authenticity and reliability. The recognition could be in the form of licenses, awards of honor, or even certificates. An Authorized Economic Operator (AEO) is one such certification that signifies a business’s authority and trustability in global trade. Getting this certificate endows business owners with a wide range of benefits and conveniences.

Who can apply for AEO? AEO Eligibility Criteria.

Generally, those businesses that are involved in the International supply chain and happen to undertake customs-related activity in the country are eligible for AEO Certification.

The size of the business does not matter. The industries that are eligible for AEO Certification include exporters, importers, logistics providers, custodians or terminal operators, warehouse owners, and customs house agents. AEO certification is not required for organizations that are not involved in customs-related work. The below image shows the criteria to get AEO certification -

The application of AEO does not cover a group of companies but only the applicant's legal entity. The business should be based in India. The applicant should have business activities for at least three financial years preceding the date of application (This condition can be waived off by the AEO Programme Manager). AEO status applies only to the legal entity in its personal capacity. Not on its client importers and exporters who will need to apply separately for the status. The AEO certification is open to small and medium enterprises as well; whose shipping bill or bill of entry is a minimum of 25 during the last financial year.

To apply for an AEO certificate, the following documents will be required

1. A certificate of registration issued by the Registrar of the company.

2. Details of places or locations, where goods are being handled.

3. Proof of business that it has its own accounts.

Simplified Eligibility Criteria for MSMEs to get AEO Certifications

In line with Aatma Nirbhar Bharat Abhiyan to support MSMEs against the challenges due to Covid – 19 Pandemic, the CBIC has analyzed the difficulties faced by all MSMEs to get the AEO certification. The board has decided to relax the entire compliance and security requirements for MSMEs.

An applicant having the MSME certificate from inline- Ministry is eligible to get the below relaxations for granting the AEO certificate. After the AEO approval, MSME must ensure to maintain their active MSME status during the validity of AEO certification.

Minimum Import – Export Documents requirement

The minimum Documents requirement has been relaxed to 10 from 25 documents during the last financial year to get the AEO Certification, subjected to handle at least 5 Documents in each half-year period of the preceding financial year.

Relaxations in business activities period

The requirement to have business activities for at least three financial years before the date of application has been relaxed to two financial years for the Applicant having MSME certificate and wish to get AEO accreditation.

Time Limit for processing the Application

The Time Limit for processing of MSME AEO T1 application has been reduced to 15 working days (Which is presently one month).

The Time Limit for processing the MSME AEO T2 application has been reduced to three months (Which is presently six months).

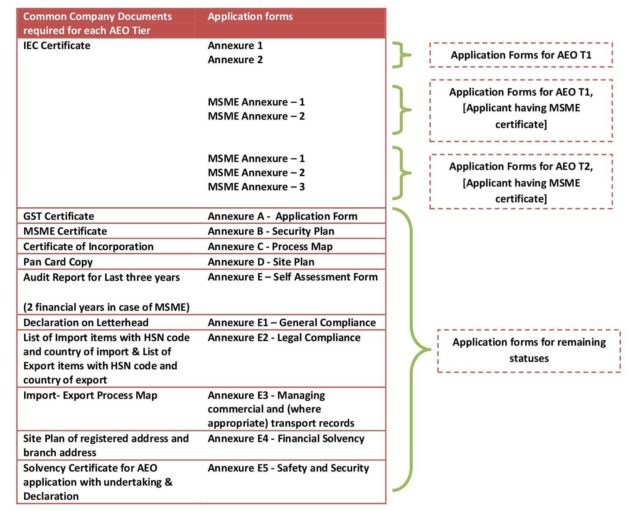

Reduced Documentation for MSMEs to get AEO T1 and T2

All the MSMEs are now required to submit only two annexures for AEO T1 and three annexures for AEO T2 to get the AEO accreditation.

Following are the two common annexures for AEO T1 and AEO T2

- MSME Annexure 1 (General Compliance)

- MSME Annexure 2 (Legal, Managing Commercial Records, and Financial Solvency Compliance)

The third annexure for AEO T2 is MSME annexure 3 (Safety and Security Requirements). These are designed to fulfill the reduced documentation requirement for AEO accreditation of MSMEs.

Relaxations in the legal and financial compliance period

The legal and financial compliance period has been reduced from the last three financial years to the last two financial years to be eligible to get the certification

Relaxation in Furnishing of Bank Guarantee (BG)

For MSME AEO T1

The benefit of relaxation in the furnishing of BG for MSME AEO T1 has been relaxed to 25% to 50%.

For MSME AEO T2

The benefit of relaxation in the furnishing of BG for MSME AEO T2 has been relaxed to 10% to 25%.

Visit the custom website to know more about the relaxation given to MSMEs - Click Here

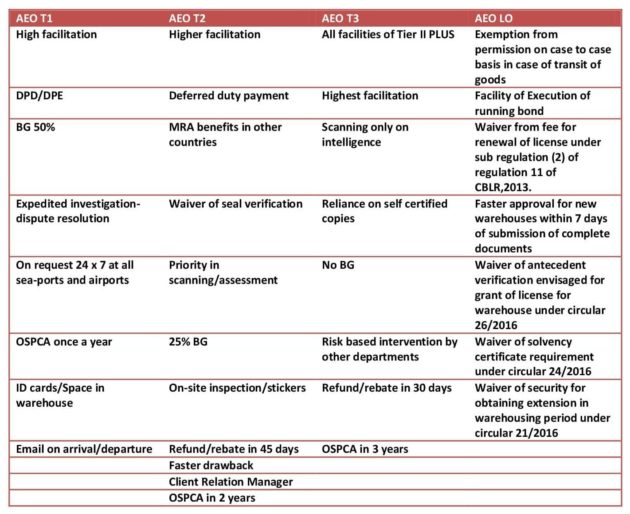

Authorized Economic Operator (AEO) Certification Benefits

Getting your business AEO Certified can help you experience an unprecedented level of trade freedom. It grants you several import/export benefits; the benefits get greater as you go up the certification tiers. The benefits of each tier are given below in the tabular form.

Note: Another Important benefit for AEO status Holders is the Self-Ratification Advance Authorisation Scheme. This Scheme is only available to AEO Status Holders. Under this Scheme, Exporters who are availing benefits of Advance Authorisation can get Advance License on Self Declaration and Self Ratification basis.

Therefore in cases where SION (Standard Input Output Norms) / Valid ad-hoc Norms for an Export Product are not fixed or where SION has been notified but the exporter intends to use additional inputs in the manufacturing process, there is no need to approach the Norms Committee for Fixation of Norms. Exporters can Redeem the Advance License on Self Ratification basis. The above Scheme is as per para 4.07 A of FTP 2015-20

Documents required for AEO Certification

Proper and right documentation makes the AEO certification process easy and organized also saves the time spent on the processing time. Proper documentation makes it easy for the AEO Programme team to review the application, hence it plays a vital role in AEO Procedure.

Find the list of Company documents and Application forms for the AEO Application under each tier.

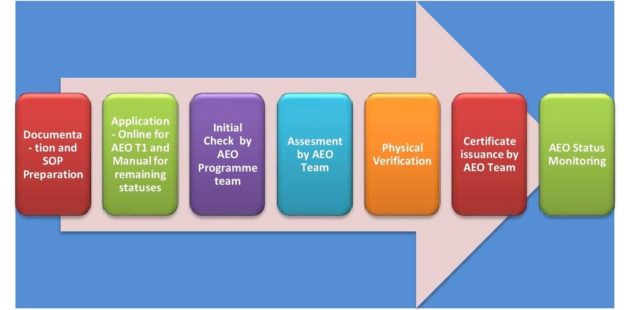

What is the AEO Registration Procedure?

Procedure to get AEO status in India

- Error-free documentation is important to obtain the AEO status to avoid application rejection by the AEO Programme team. AEO Application forms and other company documents need to be attached with the SOPs.

- Standard Operating Procedures(SOPs) are prepared to provide required information regarding the procedure followed in the organization to manage the following:-

- Procedures for administering the commercial records connected to exports/imports?

- Procedure to ensure the protection of your computerized record system from unauthorized access?

- Procedure for back-up, recovery, archiving, and retrieval of your business records.

- Online Application - Application for AEO T1 can be done online on AEO Website - https://aeoindia.gov.in/

- Manual Application - Manual applications need to be done to get the status for the remaining tiers.

- The AEO Programme Manager will not process the incomplete AEO application or if the information filled in the application doesn't match the documents attached. This has to be informed to the applicant within 30 days of application receipt.

- Physical verification is performed by the Custom team to grant AEO T2, AEO LO to verify the claims made in the application regarding fulfillment of AEO eligibility criteria are in place or not.

- AEO Certificate/Status issued by the AEO team after checking the eligibility of the applicant and document verification for AEO T1 and document plus Physical verification for remaining statuses.

- After AEO Certification issuance it has to be maintained by the firm, like if any changes made in the firm having AEO certificate need to be informed to the AEO Programme team.

How to maintain the AEO Status to avoid status cancellation?

It is a necessary step to maintain the AEO certification once you have received the AEO status. Maintenance of status is an essential part to get the maximum benefits out of the AEO Scheme.

AEO Certificate holder shall stick to the standard which has been set for them by the AEO Programme team as the AEO holder considered to be the secure trader and a reliable trading partner. To maintain the status any changes made in the company has to be informed to the AEO Programme team and the changes shall include the following –

- Changes in the person responsible for custom.

- Changes in the accounting and computing system.

- Changes in the location in the international supply chain.

- Changes in the business name or address.

- Changes in the nature of business.

- Changes in the legal entity.

The changes shall be notified to the AEO Programme Team as soon as they are made or at least within 14 days of the changes made. If there is an error made by the employee of the company in the CRM system related to the supply, the correction needs to be done immediately and the same should be corrected in the CRM system and the AEO Programme Team.

The AEO status will not get affected if the AEO team has

- 1) Examined the reason for errors.

- 2) Taken appropriate remedial action to prevent a recurrence.

Who is not entitled?

Businesses that are not engaged in customs-related work/activities may not apply for AEO certification. Thus Banks, insurance companies, consultants, and the rest of the business organization may not apply for AEO certification, as it is not of any use to them.

Who Are We and how we can help you?

- To simplify the process for you, Sairaj International provides you with guidance and assistance through each step of the procedure.

- At Sairaj International our multi-disciplinary team assists you for each phase to acquire the AEO certification and act as a “one-stop solution”.

- We work with you to form strategic decisions to get the certification in very little time.

- Our team of experts does the application online in case of AEO T1 and manual application in case of remaining tiers.

- Assist in physical verification.

- Assist in the maintenance of the AEO status.

With so many advantages of possessing an AEO Certification, you can experience faster growth for your business as these privileges will allow you to trade more freely and rapidly. Several countries have already adopted the Authorized Economic Operator Certification as a norm for conducting legitimate import/export and it holds a very positive future by maintaining integral relations in International Trade