SEIS Scheme (Service Export from India Scheme)

What is SEIS Scheme? - An Overview

The SEIS Scheme or Service Export from India Scheme is an incentive given by the Ministry of Commerce through the Directorate General of Foreign Trade (DGFT) to Service Exporters based in India. This reward scheme is to promote the export of services from India.

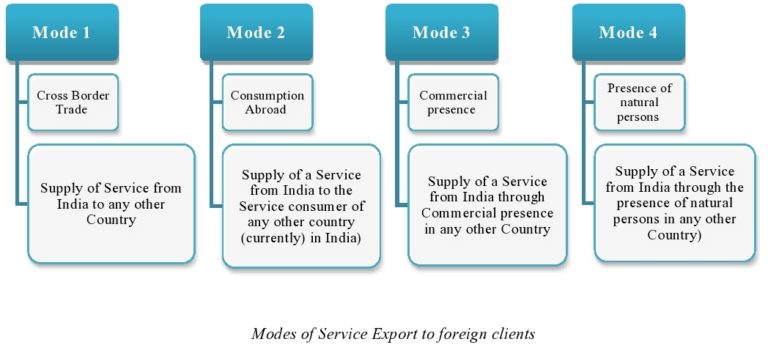

SEIS Scheme was introduced on 1st April 2015 for 5 Years under the Foreign Trade Policy of India 2015-2020. Earlier, this Scheme was named as Served from India Scheme (SFIS Scheme) for Financial Year 2009-2014. There are following four modes to export services to foreign clients.

Its main objective is to boost and maximize the export of notified/selected Services from India. Under SEIS Scheme, Exporters of selected Services are entitled to a 3% / 5% / 7% incentive on the Net Foreign exchange earned in the form of Duty Credit Scrips. These SEIS scrips can be used to pay Import duty or can be encashed by selling it to any Importer. Therefore, it is as good as cash Incentive Scheme.

Who is eligible for the SEIS Scheme?

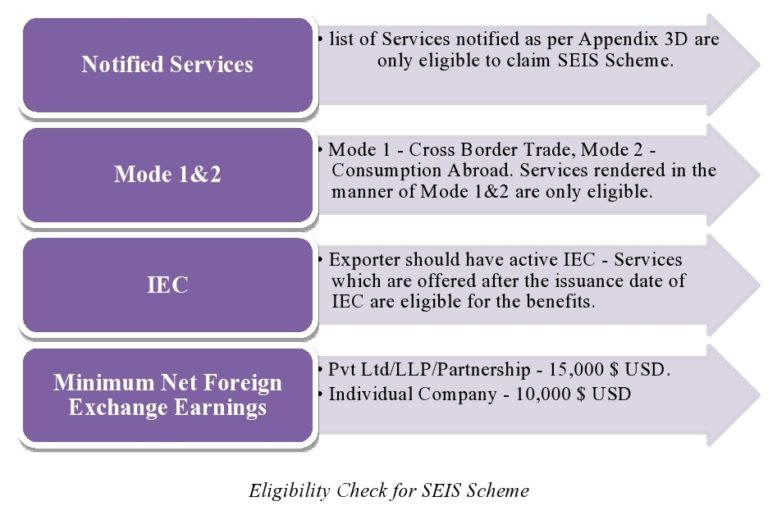

- Services rendered in the manner of Mode 1 & Mode 2 are only eligible for the SEIS Scheme. Mode 3 and Mode 4 are not eligible to claim SEIS Incentive.

- Export of services to foreign clients can be undertaking in the following four modes:

Mode 1– Cross Border Trade (Supply of Service from India to any other Country).

For Example –- An Indian Audit firm is sending audited accounts to a Foreign Company operating in London. [This may categorize as export of “Accounting & Auditing Services”]

- An Indian Company doing market research activities for a Foreign Company based in the UAE [This may categorize as export of “Market research Services”]

Mode 2 – Consumption Abroad (Supply of a Service from India to the Service consumer of any other country (currently) in India).

For example –- A Foreign Tourist from America living in a 5-star hotel in India and paying for accommodation & food in Foreign Currency through International Credit Cards. [This may categorize as Export of “Hotel Services”]

- An Indian tour operator company is planning and selling packages to foreign tourists for their travel in India. These types of companies are also known as Inbound Tour Operators. [This may categorize as export of “Travel agencies and Tour operator Services”]

Mode 3 – Commercial presence (Supply of a Service from India through Commercial presence in any other Country).

For Example – An Indian Company having an office in Singapore and providing Engineering Services to clients based in Singapore. It means the physical presence of an Indian company in foreign countries.Mode 4 – Presence of natural persons (Supply of a Service from India through the presence of natural persons in any other Country).

For example – An Indian Doctor performs surgery by visiting the patient based in the USA. / An Indian Consultant provides Services by visiting his Client in the UK. - Service providers of notified Services, as per appendix 3D, are only eligible for Service Export from India Scheme.

For Example – Software Services Exporters are not qualified for SEIS. - To claim SEIS Benefit, The Service Exporter should have an Active IEC Code.

For Example - Company XYZ has taken its Importer Exporter Code (IEC Code) on 01.04.2016, then all the Services provided by the Company after 01.04.2016 (i.e., Invoices generated after 01.04.2016) will be eligible for claiming rewards under SEIS. - Eligible Service Exporter (can be a Company, LLP, or Partnership) should have minimum net free foreign exchange earnings of 15,000 USD in the year of rendering services to apply for SEIS Scheme.

- Similarly, Individuals and Sole Proprietors should have minimum net free foreign exchange earnings of 10,000 USD to be eligible to apply under the Service Export from India Scheme.

Note: The Foreign Trade Policy 2015-2020 clearly defines the Net Foreign Exchange Earnings, which is:

Net Foreign Exchange Earnings = Gross Foreign Exchange Earnings – Total Foreign Exchange Payments/ Remittances/ Expenses bore by the Service provider in the financial year. - SEZ Units are also eligible for SEIS Scheme. But, EOU, STP, BHTP, EHTP Units are not eligible to claim SEIS incentives.

- Some eligible services are allowed to accept Indian rupees towards their service charges instead of foreign currency, which shall be deemed foreign exchange. A list of such services is given in (Appendix 3E)

- Free Foreign Exchange earned through international credit cards and other instruments, as permitted by RBI, shall also be taken into account for computation of the value of exports.

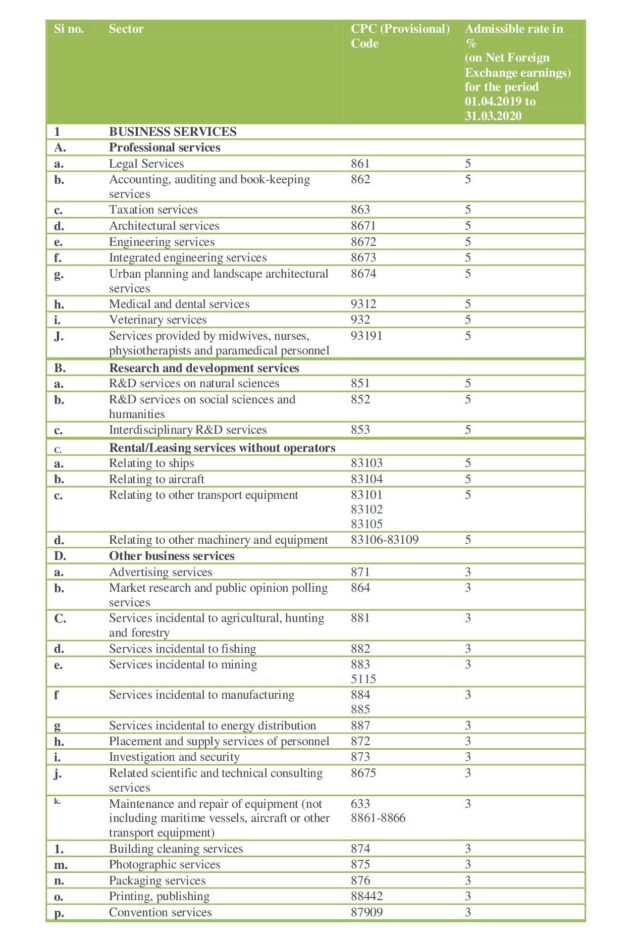

SEIS Scheme for the FY 2019-20 – Eligible services and benefit rates – (Table)

As per the Notification No. 29/2015-2020, 23rd September 2021 the SEIS scheme for the FY 2019-20 has been notified and the following points have been clarified as per the circular

a) Exporters of eligible services will be entitled to Duty Credit Scrips under SEIS for services rendered in FY 2019-20.

b) The Rate of benefit will be as notified in Appendix 3X on Net Foreign Exchange earned.

c) Total Entitlement is capped per IEC at Rs. 5 Crore under FY 2019-2020.

d) Application will be made online as per ANF 3B by 31.12.2021. There will be no provision for the late cut. The application under SEIS Scheme shall get time-barred after 31.12.2021.

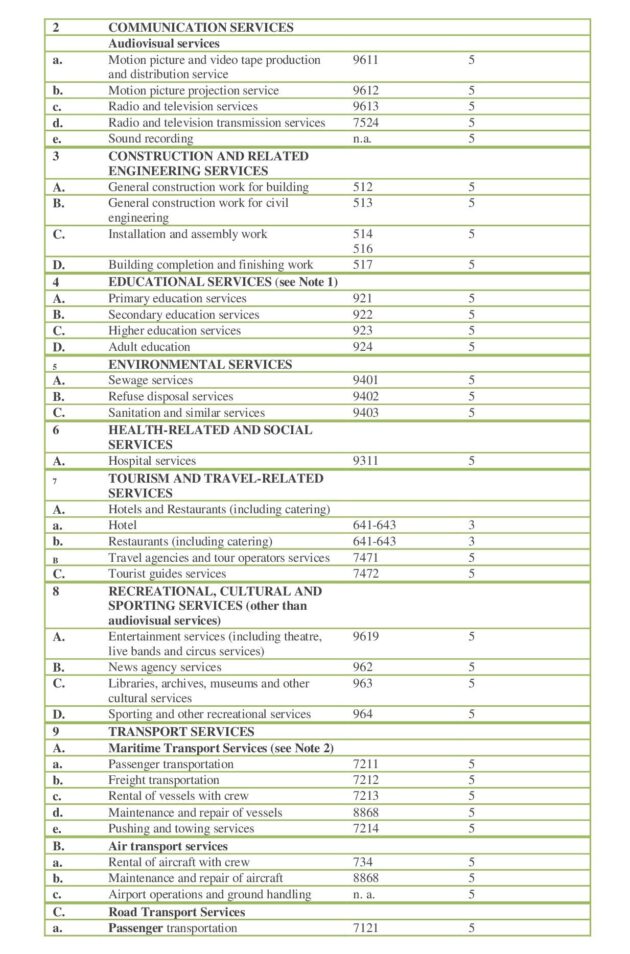

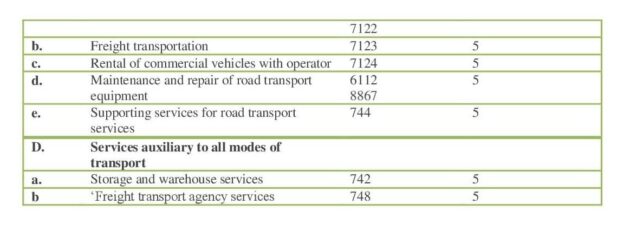

As per the Latest notification Eligible services and benefit rates has been shared below for FY 2019-2020-

SEIS Benefits for FY 2019-20 - Part 1

SEIS Benefits for FY 2019-20 - Part 2

SEIS Benefits for FY 2019-20 - Part 3

Ineligible categories under the SEIS Scheme

- All the remittances received for giving Services that are not a part of appendix 3D, will not be considered for benefit.

- This remittance precisely means that all other sources of foreign exchange earnings like equity or debt participation, donations, loan repayment receipts, etc. which is not related to the Service provided, will not be considered.

- It should be noted that the entitlement calculation under SEIS will not involve the following Services.

- Remittances of Foreign Exchange received for:

- Under the Financial Services Sector

- Raising loans of all types in foreign currency.

- Realization of Export proceeds of clients.

- Use of ADRs/GDRs/other instruments for issuance of Foreign Equity.

- Foreign Currency Bonds Issuance.

- Selling Securities and Foreign Currency Bonds.

- Selling Securities and other Financial Instruments.

- Other types of receivables which are entirely different from the Services which are rendered by the financial institutions.

- Under Regular/ Contractual employment in a foreign country

- Payments which are received from the EEFC Account for various Services.

- Equity participation, donations, etc. or any other kind of foreign exchange turnover by the Healthcare Institutions.

- Equity participation, donations, etc. or any other kind of foreign exchange turnover by the Educational Institutions.

- Turnover of various DTA Service Providers gets clubbed with the turnover of Services rendered by EOU/EHTP/STPI or BTP units.

- All the foreign exchange earnings by Airlines or even Shipping whose neither origin nor source country is India.

- Telecom Sector Service providers.

- Under the Financial Services Sector

- Remittances of Foreign Exchange received for:

What is the SEIS scrip or Duty Credit Scrip?

SEIS Incentives are given in the form of Duty Credit Scrip. It is also known as SEIS Scrip or SEIS License. It is a document that allows the entitled holder to pay import custom duties levied on the import of various Services and goods. These scrips are government-issued, and the issuing department is DGFT. The SEIS Scrips are “Freely Transferable” in nature. It means that if the Scrip Holder does not import anything, he/she can sell the SEIS license in the open market at a premium rate.

How do you use SEIS Scrips?

Let us consider Company M/S XYZ. Company is into the export of services, and they have applied for SEIS. Hence, they have received SEIS scrip for Rs. 1 Lakh (Say for Example). Now this Company is also into Import of Goods. Therefore, they can set-off this Credit of Rs. 1 Lakh against the Basic Customs Duty which is payable to them at Customs during Import of Goods.

In the above Example, Company XYZ is into the Import of Goods. But what will happen to the scrip if the Company is not importing anything? How will the Import Duty Credit be utilized? How will the scrip be beneficial to the Company? It is here where we look at the core concept of the Freely Transferable Nature of Rewards under SEIS.

It means that the Duty Credit Scrip is Freely Transferable/Saleable/Tradeable.

Therefore, it can be sold to any individual who is into Imports of Goods or Services. This freely transferable nature of Scrips is endorsed on the Duty Credit Scrip itself.

This feature is unique to only SEIS. It wasn’t present in the earlier Served from India Scheme (SFIS Scheme).

Therefore, to sum it up, Consider an organization Exporting Services worth Rs. 1 crore in a particular FY and gets rewarded duty scrip of value Rs. 5 lakh (let’s assume Rate of Reward @5%). Now, either the holder can use it to import Goods/Services without paying duties up to Rs 5 lakh or sell it out in the market (in case he doesn’t import goods or utilize it) and get money in exchange of duty scrip.

Therefore, it can be said that rewards under SEIS Scheme are as good as cash incentive, and all the service providers should take the SEIS Scheme benefits.

List of documents required for the SEIS Scheme

- Importer Exporter Code (IEC Code)

- Application form ANF-3B (Aayat Niryat Form)

- CA Certificate

- Statement showing the nexus between Invoices and FIRC’s (Table No 4)

- Write up of Services

- Self–Certified copy of invoice and FIRC’s

- DGFT Digital Signature Certificate (DSC)

- RCMC Copy

- Necessary Declarations

Procedure for applying under SEIS Scheme?

After knowing all the necessary information and terms and conditions with the list of documents associated with the SEIS Scheme, we will briefly discuss the online procedure to file the SEIS application.

Some Important points to note:

- SEIS Application should be made to jurisdictional DGFT offices using a DGFT Digital Signature.

- In this Scheme, the Exporter can apply one application for one financial year.

- One needs to claim the incentives before 12 months from the end of the relevant financial year. [A Claim submitted after 12 months would invite Late-cut/Penalty].

- Claim for a particular FY will be rejected if it is made after 3 Years from the end of the FY.

For Example – The last date of filing claim for FY 2017-18 will be 31.03.2021. - SEIS Application is to be submitted online on the DGFT website, followed by the physical submission of the required documents.

- SEIS Scrip comes with a validity of 24 months.

How to apply for SEIS Scheme online?

- Please visit DGFT website - www.dgft.gov.in

- Click on Services -> Online Ecom Application.

- A new tab will open on your browser. Here now go towards SEIS for 2017-2018 & 2018-2019. You will need to attach a DSC and then login with your credentials, and then the form will open in front of you.

- After selecting an option, you have to fill the details and submit the form.

- If you are exporting more than one Service, you have to follow the classification as per the Appendix 3D and show the “Service Category Information” in the ANF 3B form.

How can we assist you in claiming SEIS Scheme benefits from DGFT?

- We conduct Extensive Consultation with our Clients to understand the nature of their services and to determine whether they will be eligible to claim or not.

- We assist our clients in the preparation of documents in providing hassle-free services.

- Prepare and submit online applications to obtain the License under the SEIS scheme.

- Dedicated team for Follow-up at the DGFT Department for speedy processing of SEIS.

- Registration of the License done in customs from our office.

- We also assist in the selling of licenses at best available rate, provide help in documentation for the transfer of a license to the buyer.

- Also, do the online transfer by recording the details on the DGFT website.

- We complete entire process in a time bound manner.

Why Sairaj International Consultants?

We are the team of highly qualified & experienced professionals having sufficient expertise over the years in the field of DGFT Consultancy Services.

We only have the goal of providing very reliable services with the most competitive cost to the exporters under one roof.

We keep updating our clients with regular policy amendments, all the upcoming rules, and regulations in foreign trade policy.

We have a separate team for follow-up with DGFT and have a great understanding of the working of DGFT office, which helps us in obtaining SEIS licenses without delay.